Traders seeking to optimize their strategies on Australia's share market courses should analyze key economic indicators like GDP, Employment Report, RBA interest rates, and CPI to predict trends in sectors such as resources and manufacturing. Combining these insights with quarterly earnings reports and sector-specific considerations allows for informed decision-making and successful navigation of the dynamic Australian financial markets.

“Unleash your trading potential with a strategic approach to Australia’s vibrant share market. This article serves as a comprehensive guide, revealing the key Australian economic indicators that can optimize your trades. From understanding key metrics like GDP and employment rates to mastering strategies tailored for Australia’s unique market dynamics, you’ll learn how to make informed decisions. Enhance your trade performance in the diverse landscape of share market courses Australia offers, ensuring your success in this thriving financial environment.”

- Key Australian Economic Indicators for Traders

- Strategies to Enhance Trade Performance in Australia's Share Market Courses

Key Australian Economic Indicators for Traders

For traders looking to optimize their strategies, understanding key Australian economic indicators is essential. Key metrics like Gross Domestic Product (GDP) offer insights into the nation’s overall economic health and growth trajectory. Traders can leverage GDP data to anticipate market trends, especially in sectors like resources and manufacturing, which are significant contributors to Australia’s economy.

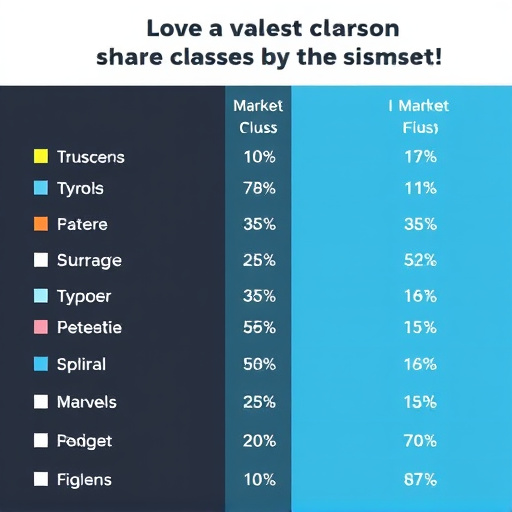

Other crucial indicators include the Employment Report, which tracks job creation and unemployment rates, providing a snapshot of the labor market. The Reserve Bank of Australia (RBA) also releases key interest rate decisions that influence borrowing costs and can significantly impact financial markets. Additionally, the Consumer Price Index (CPI) measures inflation, helping traders gauge cost-of-living adjustments and their potential effects on consumer spending. These indicators, combined with share market courses Australia offers, empower traders to make informed decisions and navigate the Australian financial landscape effectively.

Strategies to Enhance Trade Performance in Australia's Share Market Courses

To optimize trades on Australia’s share market courses, traders can employ several strategies tailored by considering key economic indicators. First, staying abreast of quarterly earnings reports and economic data releases such as GDP, employment rates, and inflation figures is crucial. These indicators offer valuable insights into corporate health and broader economic trends, enabling investors to make informed decisions about stock selection and timing.

Additionally, understanding the impact of interest rate movements by the Reserve Bank of Australia (RBA) is essential. Changes in interest rates can significantly influence market sentiment and company valuations. Traders should also consider sector-specific factors, as different industries may be more susceptible to economic cycles. Diversifying portfolios across various sectors can help mitigate risk and enhance overall trade performance in Australia’s dynamic share market courses.

By leveraging key Australian economic indicators and implementing effective trading strategies, traders can optimize their performance in the country’s dynamic share market courses. Regularly monitoring factors such as GDP growth, employment rates, and interest rates allows for informed decision-making, enabling investors to capitalize on opportunities and mitigate risks. Incorporating these insights into your trading approach can significantly enhance your success in navigating Australia’s vibrant financial landscape.